Smart Loan Payoff Calculator

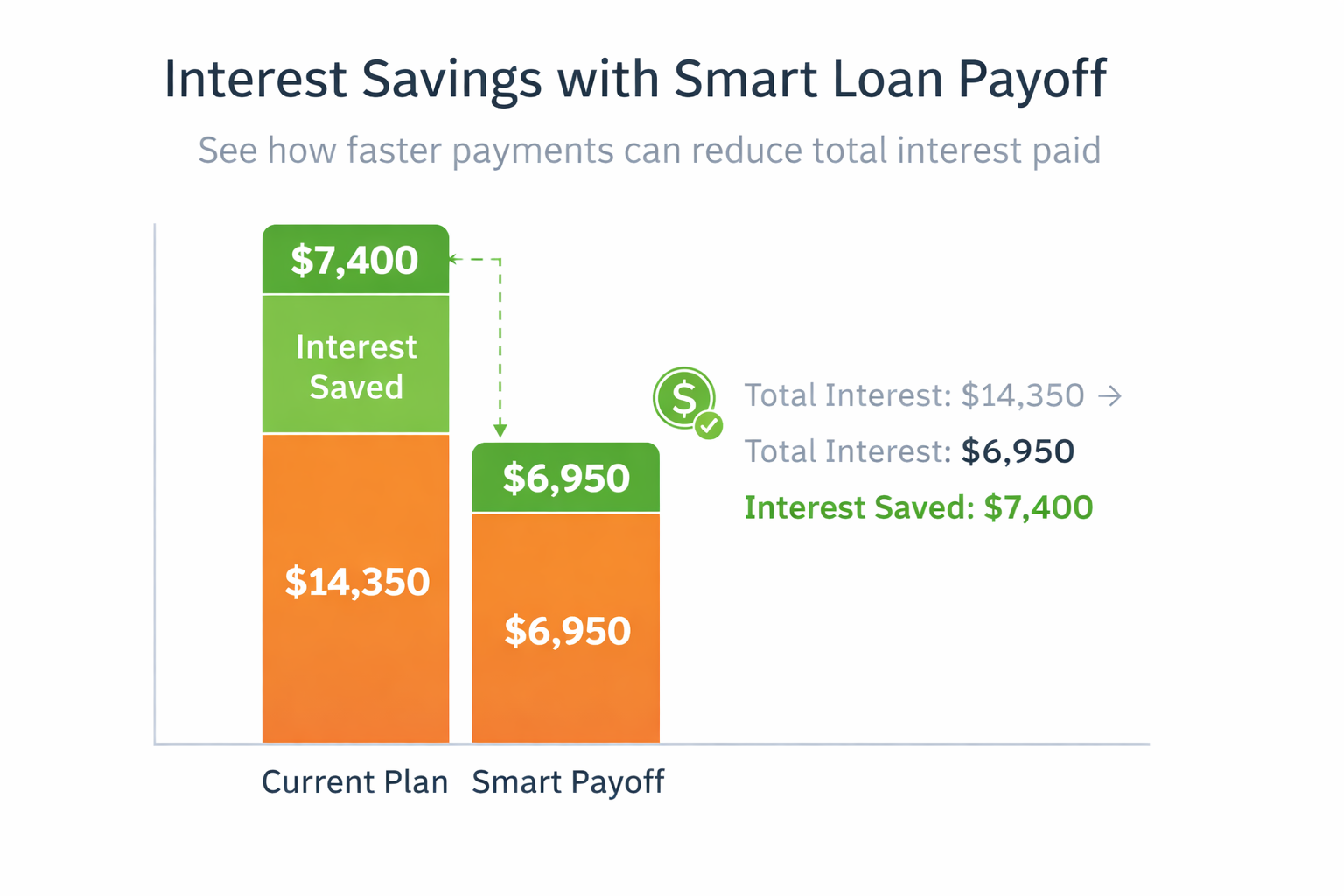

Are you tired of monthly payments eating up your paycheck? Our free Smart Loan Payoff Calculator is designed to show you the fastest path to debt freedom. By calculating the impact of extra principal payments, this tool visualizes exactly how much interest you can save and how many years you can shave off your loan term.

Loan Details

Input DataPayoff Summary

ResultsInterest

—

Payoff Date

—

Why Use a Smart Loan Payoff Calculator?

Debt can feel like a heavy anchor, but mathematics is the tool that can set you free. A Smart Loan Payoff Calculator does more than just tell you your monthly payment—it acts as a strategic roadmap to financial freedom. By understanding the mechanics of amortization and compound interest, you can make small adjustments to your budget that yield massive returns over time.

1. The Power of Principal Payments

The secret to paying off loans faster lies in understanding how interest is calculated. In the early years of a 30-year mortgage or a long-term loan, nearly 70% of your payment goes straight to interest, not the balance. This is why your balance seems to barely move.

When you make an extra principal payment, that money bypasses the interest calculation and goes 100% toward reducing your debt. This creates a snowball effect: a lower balance means less interest charged next month, which means even more of your regular payment goes to the principal.

2. How to Use This Calculator Effectively

To get the most out of this tool, follow these steps:

- Enter Accurate Data: Input your current loan balance (not the original amount), your current interest rate, and the remaining years on your term.

- Experiment with “Extra”: Try adding just $50 or $100 to the “Extra/Month” field. You will be shocked to see how a small sacrifice can cut 3-5 years off a mortgage.

- Review the Amortization Schedule: Scroll down to the yearly schedule to see the exact year the “Accelerated” plan overtakes the standard plan.

3. Strategies to Become Debt-Free Faster

Using a Smart Loan Payoff Calculator is just step one. Here are three proven strategies to accelerate your payoff date:

- The Bi-Weekly Method: Instead of paying monthly, pay half your payment every two weeks. This results in 26 half-payments (13 full payments) per year, effectively making one extra payment annually without feeling the pinch.

- Round-Up Payments: If your payment is $465, round it up to $500. The extra $35 goes straight to principal.

- Windfall Attacks: Whenever you get a tax refund, work bonus, or birthday money, throw it immediately at the principal.

4. When Should You NOT Pay Off Loans Early?

While being debt-free is a noble goal, it’s not always the mathematically correct choice. If your loan interest rate is very low (e.g., a 3% mortgage), and the stock market averages 7-10% returns, you might be better off investing that extra money rather than paying down cheap debt. Always compare your loan interest rate against your potential investment rate of return. However, for high-interest debt like credit cards or personal loans (10%+), paying them off early is guaranteed to be the best investment you can make.

Related Financial Tools

External References

- Consumer Financial Protection Bureau (CFPB) – Understanding loan terms.

- Investopedia: Amortization Explained