Compound Interest Calculator

Don’t let inflation fool you. A million dollars in 30 years won’t buy what it does today. This calculator shows your Nominal Growth (the number in your account) versus your Real Purchasing Power.

Investment Strategy

InputFuture Value

ProjectionsHow to Become a Millionaire with Compound Interest

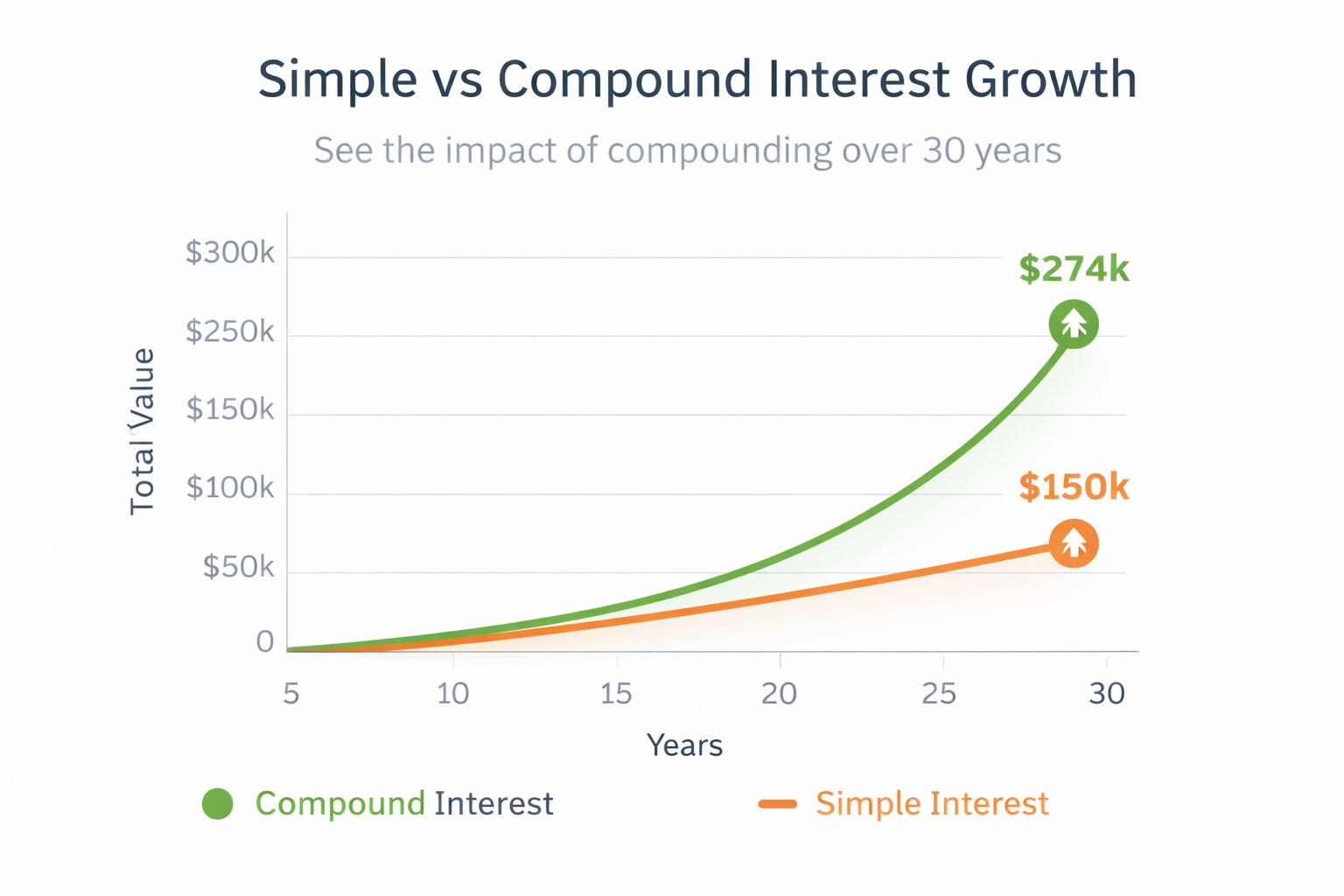

Compound interest is the mathematical explosion that happens when your “money makes money.” Unlike simple interest, where you only earn profit on your original deposit, compounding allows you to earn interest on your interest.

This Compound Interest Calculator is distinct because it supports global currencies and allows you to adjust for Inflation, giving you a realistic picture of your future purchasing power.

The Mathematical Formula

For those who want to check the math manually, here is the standard formula used by financial institutions:

- A: The future value of the investment/loan.

- P: The principal investment amount.

- r: The annual interest rate (decimal).

- n: The number of times interest compounds per year.

- t: The number of years.

The “Silent Killer”: Inflation Drag

Most calculators show you a big number, like “1,000,000.” But in 30 years, due to inflation (avg 3%), that million might only buy what 411,000 buys today.

Always use the “Adjust for Inflation” toggle in this tool to see your “Real Wealth.” If your investment returns 7% but inflation is 3%, your real return is actually only about 4%.